johnson county kansas vehicle sales tax calculator

The minimum combined 2022 sales tax rate for Johnson County Kansas is. The state sales tax applies for private car sales in Kansas.

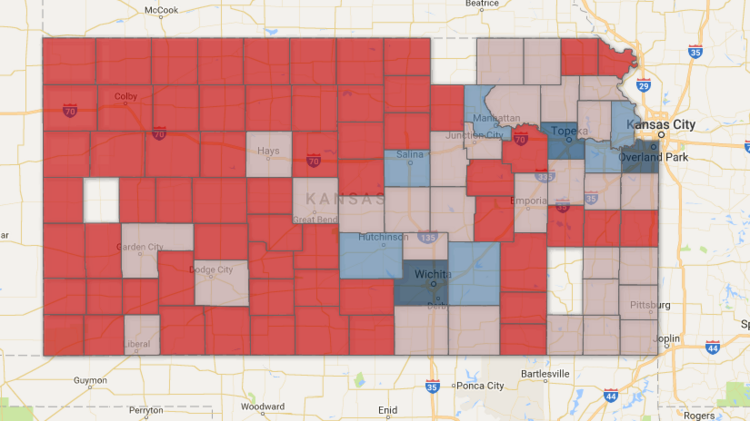

Topeka Shawnee County Toward The Middle In Kansas Sales Tax Rates

The rate ranges from 75 and 106.

. This is the total of state and county sales tax rates. Sales Tax Table For Johnson County Kansas. Sales Tax Table For Johnson County Kansas.

Kansas State Sales Tax. Select community details then click. Johnson County Sales Tax Rates for 2022.

Treasury Taxation and Vehicles. Maximum Local Sales Tax. Treasury Taxation and Vehicles merges the functions of the County Clerk Register of Deeds and Treasurer into one department.

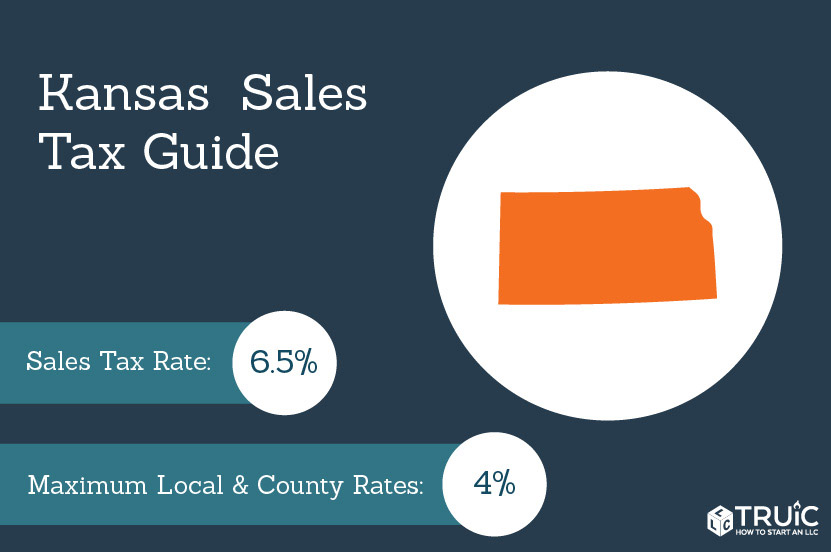

Johnson County in Kansas has a tax rate of 798 for 2022 this includes the Kansas Sales Tax Rate of 65 and Local Sales Tax Rates in Johnson. The Kansas state sales tax rate is currently. Kansas has a 65 statewide sales tax rate but also.

The calculator will show you the total sales tax amount as well. For instance if you purchase a vehicle from a private party for 27000 and you live in a county. Kansas has a 65 sales tax and Johnson County collects an additional.

There are also local taxes up to 1 which will vary depending on region. Maximum Possible Sales Tax. The kansas sales tax rate is currently.

The Johnson County Kansas Sales Tax Comparison Calculator allows you to compare Sales Tax between all locations in Johnson County Kansas in the USA using average Sales Tax Rates. The Johnson County Kansas sales tax is 798 consisting of 650 Kansas state sales tax and 148 Johnson County local sales taxesThe local sales tax consists of a 148 county. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

2020 rates included for use while preparing your income tax. The Johnson County Kansas sales tax is 798 consisting of 650 Kansas state sales tax and 148 Johnson County local sales taxesThe local sales tax consists of a 148 county sales. Average Local State Sales Tax.

Johnson county kansas vehicle sales tax calculator. Johnson county kansas vehicle sales tax calculator. Average local state sales tax.

Whether or not you have a trade-in. This rate includes any state county city and local sales taxes. Average Local State Sales Tax.

The total sales tax rate in any given location can be broken down into state county city and special district rates. You pay property tax when you initially title and register a vehicle and each year when you renew your vehicle tags and registration. For comparison the median home value in Johnson County is.

The latest sales tax rate for Johnson County KS. Vehicle property tax is due annually. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

The core responsibilities are tax calculation billing and distribution. Below is a table of common values that can be used as a quick lookup tool for an average sales tax rate of 928 in Johnson County Kansas. The Johnson County Property Tax Division serves as both the County Clerk and Treasurer.

The median property tax on a 20990000 house is 266573 in. In addition to taxes car. Kansas collects a 73 to 8775 state sales tax rate on the purchase of all vehicles.

Motor Vehicle Refunds Johnson County Kansas

Motor Vehicle Johnson County Kansas

Which Counties Pay The Most Taxes In Kansas You Ve Probably Guessed Correctly Wichita Business Journal

Kansas Vehicle Sales Tax Fees Find The Best Car Price

Johnson County Kansas Homeowners May See 11 Property Value Increase

Johnson County Kansas Legends Of Kansas

Sales Tax Bonner Springs Ks Official Website

Vehicle Ownership Guide Johnson County Kansas

Johnson County Kansas Legends Of Kansas

Johnson County Kansas Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

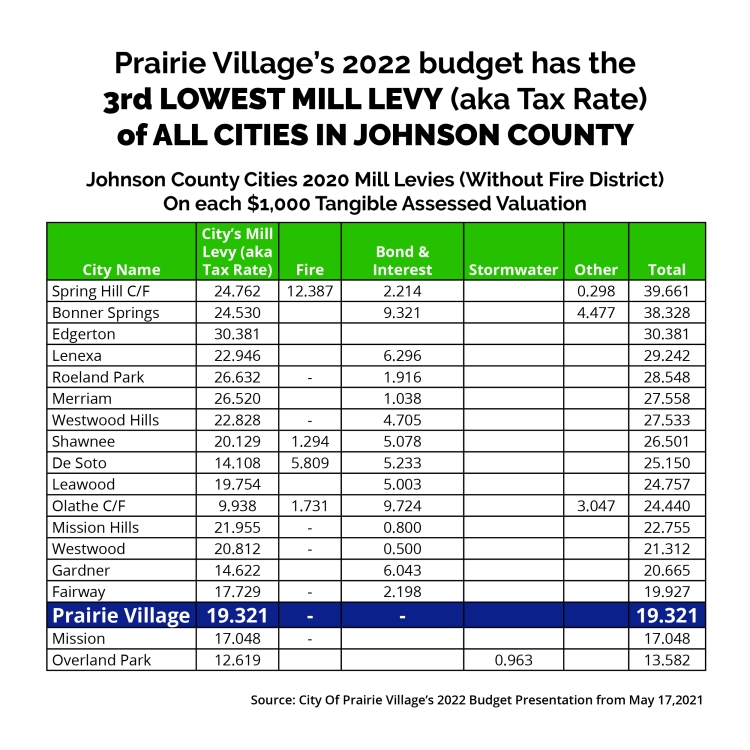

Vote Gregory Shelton Nov 2nd Prairie Village City Council Ward 5

She Works In Johnson County But Affordable Housing There Is Hard To Find Klc Journal

Car Tax By State Usa Manual Car Sales Tax Calculator

Vehicle Registrations And Titling Johnson County Kansas

Kansas Sales Tax Small Business Guide Truic

Greenlight Hot Pursuit 2008 Ford Crown Victoria Johnson County Ks Sheriff K9 Ebay

Johnson County Property Values Continue Sharp Rise New Homes Going For 550 000 On Average